Free Shipping for orders above N50000 in Lokoja.

How to Determine Efficient Capital Structure for your Small Business 2022

The Missing Manual technical brief

written by Dayo Olorunfemi [Business Analyst, Sherd Social–Enterprise]

This practical guide was produced as the missing manual to share experiences gained over a number of years by practitioners in the field of business development services (BDS) who have worked with small business owners in building a successful enterprise from the scratch.

The conceptual framework of the capital structure manual is based on 10 years work of the author in product design, business analysis, investment evaluation, market research and operations management for small businesses in Nigeria.

The manual is designed for owners of product or service-based enterprise who have no formal training/skills in running small business. Also, for young or old people interested in starting a new and sustainable business, understanding the right capital structure is nonetheless critical for beginners.

Inadequate Capital: Does it cause small business failure?

From our experience and monitoring of small business performance in Nigeria informal sector, the key observations of small business daily operations shows that while sales records are often kept manually, the volume of records are not linked to direct input cost and as such the business owner cannot understand why cash available is not adequate to pay for inventory, staff salaries and in fact, the business cash savings is grossly inadequate to support further investment or expansion plan.

Due to these associated cash-flow deficits; many micro startups and small-scale family enterprises are at greater risk of failing now or in nearest future if the business owner does not understand the basic elements of mobilizing finance or raising additional capital.

Defining Capital for Small Scale Business

In our simple definition, startup capital is the little by little drop of cash or token of an amount of money that you have saved personally which comes from your daily side hustle (being paid by others for a form of service you render) or saving up to 5%–10% of your monthly pension or salary (for working civil servants, teachers, private employees) and setting aside or budgeting a certain amount of money saved in the bank towards starting up a new business venture (e.g starting a farm as a business, sanitation venture as a service or developing marketable handwork skills for a fee in your community).

What is Capital Structure?

Capital structures simple implies the mix of different types of funding options to fiancé your business activities aimed towards attaining desired goal either in the short term or long term.

Every business venture whether large, medium or small scale has a revolving life cycle. So, start small and grow your business step-by-step because success is a process and learning about customers and the market is not a simple journey.

Take for example, when you ask an unemployed youth or retired civil servant why he or she did not start a small-scale business to generate income, the common complaint or response is the “lack of capital”.

What then is the right size of capital needs for a small-scale business and what should this capital be used for?

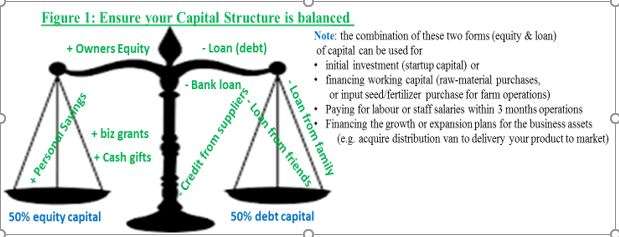

This missing manual on capital structure present significant lessons for youths or elder people who desires to start a new business from the scratch and also educate owner of existing small business to always define why they need additional capital and what specific goals or business needs will their capital be used for –as itemized with bullet points in figure 1 above.

For any startup to properly blend personal savings of the business owners (equity capital) with loans from microfinance bank, note that:

- You don’t have to wait until the loan collected become due before you start to payback the interest on loan obtained.

- Be informed that loan officers may start to chase you around if you default in repaying the principal on loan for your business as at due date.

- The treatment of principal and interest on loan is accounted for as cost of capital and if these costs are not carefully controlled the interest graduate to cumulative interest as against simple interest allotted to loan obtained from a friend or credit on input from your suppliers.

- Therefore, when you neglect to control the amount of bank loan taken to run your startup or existing small-scale business, the excessive usage of loan can lead to your bankruptcy or failure of business venture.

Proven Strategies to Avoid Disaster in your Business Capital Structure

To achieve a defined investment goal for existing business, why not consider first to implement 50% equity and 50% loan that is a 1:1 ratio for your capital structure decision in the short term. From my experience as a business owner, it is important to determine the right capital structure to drive your business investment needs.

Ask yourself this basic question:

- What if your best choice to finance working capital is to blend 70% personal savings (including profit for sales) and 30% debt or

- Obtain flexible asset loan from microfinance bank who want to see that your business progresses from small to medium scale?

Conclusion

From experience and observation of why many small businesses fails, the worst-case finance scenario is to use 100% bank loan to meet the purchase of fixed assets profiled with more than 10% interest with repayment plan of 12 months on such loan from the bank.

Take for example: If managers of large-scale business are careful in using 100% loan component in their capital structure, how much more negative effect do you think this decision will amount to for your small-scale business which is just beginning to win customers and gain gradual understanding of market competition and risk?

The scope of this missing manual series volume 1, have not covered business management skills that every small-scale enterprise owner must possess. So, ask yourself this basic questions.

- Do you have the necessary business management skills to start and run a new profitable business?

- What form or nature of business should you register?

- Do you have the capacity to manage human resources?

- Which kind of human resources do you think your business requires to start and grow?

- How do you handle the financial planning and business planning to commence the startup phase?

- How will you determine or select the optimal capital structure to get your business out of cash trouble?

If you desire to know more and you need further support, you can contact Sherd Social–Enterprise Business Development Services (BDS) expert or call us: +2349039345425